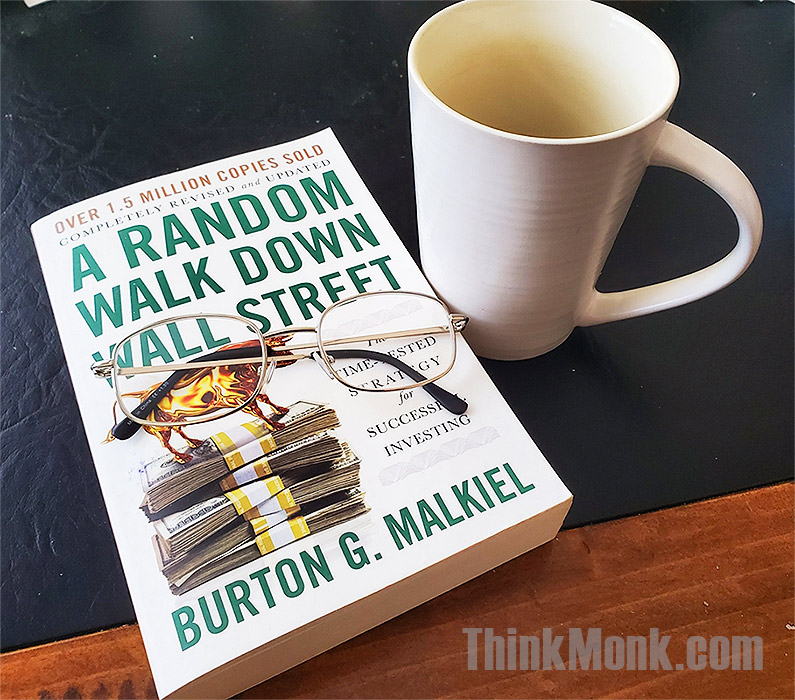

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing by Burton G. Malkiel is an investing classic that has been around since 1973 and has had multiple revisions and updates to keep up with the times. This 2020 edition that I have just read even discusses bitcoin and crypto currencies!

Don’t expect much information on piling all of your wealth into the crypto market in this book though as Index Funds are the answer to whatever question you’re asking. Malkiel pushes the efficient-market hypothesis where the price of stocks reflect what they’re worth. So an exchange-traded fund (ETF) that simply tracks an index like the S&P 500 (500 largest listed companies in the United States) or the S&P ASX 200 (200 largest listed companies in Australia) should outperform an actively managed mutual fund run by professionals who spend their entire life looking for the best stock investments.

So he’s saying that you can’t beat the market and you can’t pick a mutual fund that will outperform. Just put the bulk of your money into low cost ETFs and hang in there for the long term. I’m not going to argue with him as he’s right. Says me who has about 3 percent of his stock portfolio invested in exchange-traded funds! I do plan to increase that number to more than 50% of my stocks though.

Who is the book for?

Anyone who doesn’t currently have a passive investment income of more than $50,000 per year should buy this book. Also anyone invested in stocks and receiving a return of less than the market average. Which pretty much covers everyone, right?

I’m giving A Random Walk Down Wall Street a very healthy 7 Stars out of 10. If you know nothing about index funds or you have nothing invested in stocks then this is easily a 9 star book!

Book Details

Book Title: A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing

Book Author: Burton Gordon Malkiel

Book Publisher: W. W. Norton & Company

First published in 1973. This edition is revised and updated in 2020.

Paperback. 473 numbered pages. Index starts at page 459.

Quotes from A Random Walk Down Wall Street Book

Greed run amok has been an essential feature of every spectacular boom in history. In their frenzy, market participants ignore firm foundations of value for the dubious but thrilling assumption that they can make a killing by building castles in the air. Burton G. Malkiel

The harsh truth is that the most important driver in the growth of your assets is how much you save, and saving requires discipline. Without a regular savings program, it doesn’t matter if you make 5 percent, 10 percent, or even 15 percent on your investment funds. The single most important thing you can do to achieve financial security is to begin a regular savings program and to start it as early as possible. Burton G. Malkiel

In the 1990s, the ratio of buy to sell recommendations climbed to 100 to 1, particularly for brokerage firms with large investment banking businesses. Burton G. Malkiel

For many of us, trying to outguess the market is a game that is much too much fun to give up. Even if you were convinced you would not do any better than average, I’m sure that most of you with speculative temperaments would still want to keep on playing the game of selecting individual stocks with at least some portion of the money you invest. Burton G. Malkiel

Table of Contents: Book Chapters

- Preface

- Acknowledgments from Earlier Editions

- Part 1. Stocks and Their Value

- 1. Firm Foundations and Castles in the Air

- 2. The Madness of Crowds

- 3. Speculative Bubbles from the Sixties into the Nineties

- 4. The Explosive Bubbles of the Early 2000s

- Part 2. How the Pros Play the Biggest Game in Town

- 5. Technical and Fundamental Analysis

- 6. Technical Analysis and the Random-Walk Theory

- 7. How Good Is Fundamental Analysis? The Efficient-Market Hypothesis

- Part 3. The New Investment Technology

- 8. A New Walking Shoe: Modern Portfolio Theory

- 9. Reaping Reward by Increasing Risk

- 10. Behavioral Finance

- 11. New Methods of Portfolio Construction: Smart Beta and Risk Parity

- Part 4. A Practical Guide for Random Walkers and other Investors

- 12. A Fitness Manual for Random Walkers and Other Investors

- 13. Handicapping the Financial Race: A Primer in Understanding and Projecting Returns from Stocks and Bonds

- 14. A Life-Cycle Guide to Investing

- 15. Three Giant Steps Down Wall Street

- Epilogue

- Some Last Reflections on Our Walk

- Supplement: How Pork Bellies Acquired an Ivy League Suit: A Primer on Derivatives

- Appendix to Supplement: What Determines Prices in the Futures and Options Markets?

- A Random Walker’s Address Book and Reference Guide to Mutual Funds and ETFs

- Index

More on Stock Market Investing and Author Burton G. Malkiel

Have you read A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing? How has it changed the way you invest in stocks?

- Burton Malkiel Quotes – Browse famous quotes about finance, investing ETFs, mutual funds, business and stock markets.

- Burton Malkiel Biography – Information on the life of the famous economist and financial writer.

Related authors include: Peter Lynch, John C. Bogle and Warren Buffett.

Leave a Reply